Google Just Kickstarted a New AI Spending Wave. Buy This Top-Rated Stock to Benefit.

/AI%20(artificial%20intelligence)/Hands%20of%20robot%20and%20human%20touching%20on%20big%20data%20network%20connection%20by%20PopTika%20via%20Shutterstock.jpg)

Artificial intelligence (AI) stocks have become some of Wall Street’s most powerful growth drivers, as companies invest billions into cloud infrastructure, advanced chips, and generative AI platforms. Google (GOOGL) just lit a fresh spark by raising its 2025 capital expenditure target to $85 billion, most of it aimed at AI servers and data centers, a move that could set off a broader spending wave among its Big Tech peers.

One stock particularly well positioned to benefit is Amazon (AMZN). Ranked as one of the top-rated AI stocks with a large U.S. presence by Barchart, Amazon is already a leader in AI-driven cloud services through AWS, powering everything from machine learning tools to foundation models. With Big Tech racing to expand AI capacity, Amazon’s scale and early lead make it a prime candidate for long-term growth.

About Amazon Stock

Founded in 1994 by Jeff Bezos, Amazon has grown into one of the world’s most influential companies, built on a foundation of innovation, customer focus, and operational excellence.

Amazon’s unique ecosystem spans e-commerce, cloud computing, and digital services. Its extensive fulfillment network and technologies such as AWS and custom silicon chips give it a strong competitive edge. The company’s ongoing investments in artificial intelligence and automation continue to position it as a leader in both retail and cloud markets.

With a market capitalization of $2.46 trillion, Amazon’s shares have made an impressive recovery from April’s slump. Despite market volatility fueled by tariffs, the stock is still up 6.1% year-to-date.

Amazon’s valuation remains elevated, similar to other members of the “Magnificent Seven.” Its price-sales ratio stands at 3.9x, well above the sector median of 1x. However, a trailing PEG ratio of 0.52x makes it about 36% cheaper than the sector median, suggesting some room for upside.

AWS at the Forefront of AI Innovation

Amazon Web Services (AWS) is central to Amazon’s AI strategy. AWS offers a complete AI stack from custom processors to cloud AI services and tools. For example, AWS builds its own AI hardware (custom Inferentia and Trainium chips) and provides managed AI services like Amazon Bedrock (for large language and vision models) and Amazon Nova (a new suite of proprietary AI models).

Amazon Is Set to Report Q2 Earnings

Amazon will report Q2 2025 (June quarter) results on July 31, after the closing bell.

Analysts currently expect second-quarter revenue of roughly $162 billion, up about 9.5% year-over-year. This is near the high end of Amazon’s own guidance of between $159 billion and $164 billion. Analysts expect 8.1% growth in earnings per share to $1.33.

Amazon’s stated guidance was broad, calling for operating income between $13 billion and $17.5 billion, reflecting uncertainties, but Wall Street’s view is optimistic. The AWS and Ads segments, fueled by enterprise AI demand and retail media trends, are expected to drive most of this growth.

What Do Analysts Say About AMZN Stock

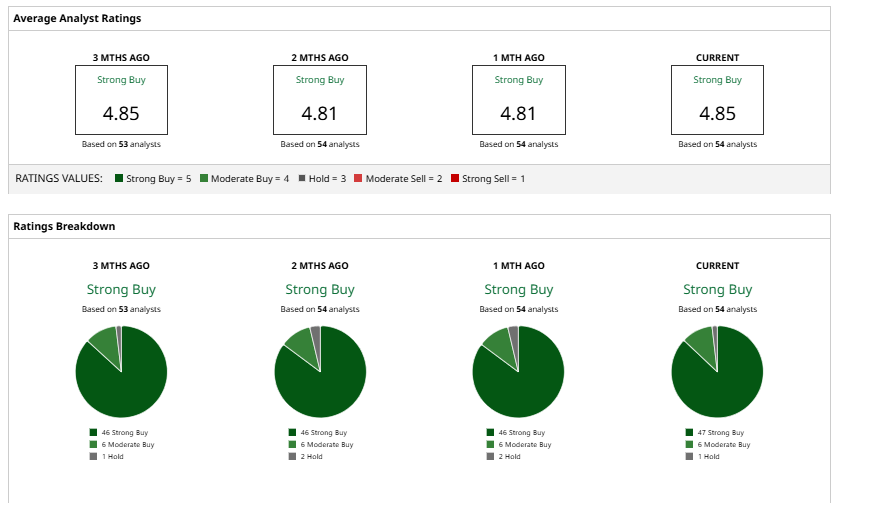

Amazon currently carries a “Strong Buy” consensus among Wall Street analysts. According to Barchart, 47 rate it a “Strong Buy,” six rate it a “Moderate Buy” and one rates it a “Hold.” The average 12‑month price target sits at $254.38, suggesting about 10% upside from current levels.

Among notable calls, Morgan Stanley recently named Amazon its top internet stock, pointing to accelerating AWS growth and the boost from generative AI. Baird’s Colin Sebastian reiterated an “Outperform” rating, highlighting the potential of Project Kuiper and raising his target from $220 to $244. Bank of America also lifted its target to $265 while maintaining a “Buy” rating ahead of Q2 earnings.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.